All Taxing Districts

ASSESSORCanyon County property tax bills are consolidated. This means that a tax payer will receive one property tax bill that contains charges from any number of different agencies. Each parcel may support a half dozen or more taxing districts. A parcel may also be imposed fees that are billed on the consolidated property tax bill. Consolidating all of these charges onto one bill helps keep administrative costs low for Canyon County tax payers.

Below is a list of all the taxing districts and types of fees that may appear on a Canyon County tax bill. To learn more about each entity listed please take advantage of their contact information provided below. The taxing districts supported by your property are listed on your assessment notice and tax bill.

List of Taxing Districts

All links below are external ![]()

![]()

| Code | Taxing District | Phone Number | Website or Other Contact Information |

|---|---|---|---|

| 112 | Pest Control | 208-459-0510 | Canyonco.org/About-Pest-Control |

| 113 | Melba Gopher | 208-454-7507 | PO Box 209, Melba, ID 83641 |

| 640 | Greater Middleton Recreational District | 208-585-3461 | GreaterMiddletonParksAndRec.org |

| 641 | Ten Davis Recreational District | 208-722-6667 | 25731 Don Lane, Parma, ID 83660 |

| 653 | Ambulance District | 208-795-6920 | ccParamedics.com |

| 654 | Nampa Highway District #1 Special | 208-467-6576 | NampaHighway1.com |

| 655 | DSD Property Abatement | 208-454-7300 | CanyonCo.org/DSD/Code-Enforcement |

| 656 | County Weed Special | 208-459-0510 | CanyonCo.org/Weed-Control |

| 657 | Wilder City Special | 208-482-6204 | CityofWilder.org |

| 658 | Canyon Highway #4 Special | 208-454-8135 | Canyonhd4.org |

| 659 | Parma City Special | 208-722-5138 | ParmaCity.net/Public-Works |

| 660 | Caldwell City Special | 208-455-3000 | CityofCaldwell.com |

| 661 | Nampa City Special | 208-468-5473 | CityofNampa.us |

| 662 | Gopher Special | 208-459-0510 | CanyonCo.org/Weed-Control |

| 663 | Ada County Special | 208-287-6800 | AdaCounty.ID.gov |

| 664 | Middleton City Special | 208-585-6611 | Middleton.ID.gov |

| 668 | Mosquito Abatement | 208-461-8366 | 2cmad.org |

| 675 | City of Caldwell | 208-455-4656 | CityofCaldwell.com |

| 676 | City of Nampa | 208-468-4430 | CityofNampa.us |

| 677 | City of Melba | 208-495-2722 | CityofMelba.org |

| 678 | City of Middleton | 208-585-3133 | Middleton.ID.gov |

| 679 | City of Notus | 208-459-6212 | NotusIdaho.org |

| 680 | City of Parma | 208-722-5138 | ParmaCity.net |

| 681 | City of Wilder | 208-482-6204 | CityofWilder.org |

| 682 | City of Greenleaf | 208-454-0552 | Greenleaf-Idaho.us |

| 683 | City of Star | 208-286-7247 | StarIdaho.org |

| 690 | Nampa Highway District #1 | 208-467-6576 | NampaHighway1.com |

| 691 | Nampa Highway District #1 in Nampa | 208-467-6576 | NampaHighway1.com |

| 692 | Nampa Highway District #1 in Melba | 208-467-6576 | NampaHighway1.com |

| 693 | Notus-Parma Highway District #2 | 208-722-5343 | nphd.net |

| 694 | Notus-Parma Highway #2 in Notus | 208-722-5343 | nphd.net |

| 695 | Notus-Parma Highway #2 in Parma | 208-722-5343 | nphd.net |

| 696 | Golden-Gate Highway #3 | 208-482-6267 | gghd3.org |

| 697 | Golden-Gate Highway #3 in Wilder | 208-482-6267 | gghd3.org |

| 698 | Golden-Gate Highway #3 in Greenleaf | 208-482-6267 | gghd3.org |

| 699 | Canyon Highway District #4 | 208-454-8135 | Canyonhd4.org |

| 700 | Canyon Highway #4 in Caldwell | 208-454-8135 | Canyonhd4.org |

| 701 | Canyon Highway #4 in Middleton | 208-454-8135 | Canyonhd4.org |

| 702 | Notus-Parma Highway #2 in Caldwell | 208-722-5343 | nphd.net |

| 703 | Nampa Highway District #1 in Caldwell | 208-467-6576 | NampaHighway1.com |

| 704 | Canyon Highway District #4 in Nampa | 208-454-8135 | Canyonhd4.org |

| 705 | Canyon Highway District #4 Star | 208-454-8135 | Canyonhd4.org |

| 710 | Caldwell Rural Fire | 208-250-6724 | CityofCaldwell.com/Fire |

| 711 | Homedale Fire | 208-337-3271 | CityofHomedale.com/Fire |

| 712 | Kuna Fire | 208-922-1144 | KunaFire.com |

| 713 | Melba Fire | 208-957-8669 | MelbaFire.ID.gov |

| 714 | Middleton Fire | 208-585-6650 | MiddletonFire.org |

| 715 | Parma Fire | 208-250-5041 | ParmaFire.com |

| 716 | Upper Deer Flat Fire | 208-880-1888 | 5691 Diamond Ridge Way, Nampa, ID 83686 |

| 717 | Marsing Fire | 208-880-8770 | PO Bose 299, Marsing, ID 83639 |

| 718 | Star Fire | 208-286-7772 | StarFireRescue.org |

| 719 | Wilder Fire | 208-482-7563 | WilderFireDistrict.org |

| 720 | Nampa Fire | 208-468-5770 | NampaFireFighters.com |

| 730 | Fairview Cemetery | 208-466-9272 | 5700 E. Franklin RD, Ste 200, Nampa, ID 83687 |

| 731 | Greenleaf Cemetery | 208-250-6724 | Greenleaf-Idaho.us/Cemetery |

| 732 | Kuna Cemetery | 208-559-4017 | 2390 N. Locust Grove, Kuna, ID 83634 |

| 733 | Lower Boise Cemetery | 208-722-6224 | 22410 Ted Davis RD, Parma, ID 83660 |

| 734 | Melba Cemetery | 208-465-2600 | MelbaCemetery.org |

| 735 | Middleton Cemetery | 208-871-3547 | MiddletonCemetery.org |

| 736 | Parma Cemetery | 208-722-4033 | PO Box 969, Parma, ID 83660 |

| 737 | Roswell Cemetery | 208-722-6467 | 27922 Pet Lane, Parma, ID 83660 |

| 738 | Wilder Cemetery | 208-482-6858 | 20431 Batt Corner RD, Wilder, ID 83676 |

| 739 | Pleasant Ridge Cemetery | 208-454-9001 | PO Box 58, Houston, ID 83630 |

| 750 | Wilder Library | 208-482-7880 | CityofWilder.org/Library |

| 751 | Lizard Butte Library | 208-896-4690 | LizardButte.lili.org |

| 752 | Kuna Library | 208-922-1025 | KunaLibrary.org |

| 760 | Meridian School District #2 | 208-350-5007 | WestAda.org |

| 761 | Kuna School District #3 | 208-955-0286 | KunaSchools.org |

| 762 | Nampa School District #131 | 208-573-9054 | nsd131.org |

| 763 | Caldwell School District #132 | 208-455-3300 | CaldwellSchools.org |

| 764 | Wilder School District #133 | 208-482-6228 | WilderSchoolDist.weebly.com |

| 765 | Middleton School District #134 | 208-585-3027 | msd134.org |

| 766 | Notus School District #135 | 208-459-7442 | NotusSchools.org |

| 767 | Melba School District #136 | 208-495-1141 | MelbaSchools.org |

| 768 | Parma School District #137 | 208-722-5115 | ParmaSchools.org |

| 770 | Vallivue School District #139 | 208-454-0445 | Vallivue.org |

| 771 | Marsing School District #363 | 208-896-4111 | MarshingSchools.org |

| 772 | Homedale School District #370 | 208-337-4611 | HomedaleSchools.org |

| 775 | College of Western Idaho | 208-562-3500 | CWIdaho.cc |

| 780 | Flood Control District #10 | 208-859-8257 | BoiseRiver.org |

| 781 | Flood Control District #11 | 208-459-2838 | PO Box 729, Parma, ID 83660 |

| 785 | Drain District #2 | 208-629-7447 | PO Box 7985, Boise, ID 83707 |

| 786 | Drain District #3 | 208-722-5044 | PO Box 729, Parma, ID 83660 |

| 787 | Drain District #4 | 208-722-5044 | PO Box 729, Parma, ID 83660 |

| 788 | Drain District #6 | 208-863-7371 | 23228 Boise River RD, Caldwell, ID 83607 |

| 789 | Admin Fee for Special Assessments | 208-454-7355 | Canyonco.org/Treasurer |

| 790 | Star Sewer & Water District | 208-286-7388 | StarSWD.com |

| 998 | Canyon County | 208-454-7507 | canyoncounty.id.gov/commissioners |

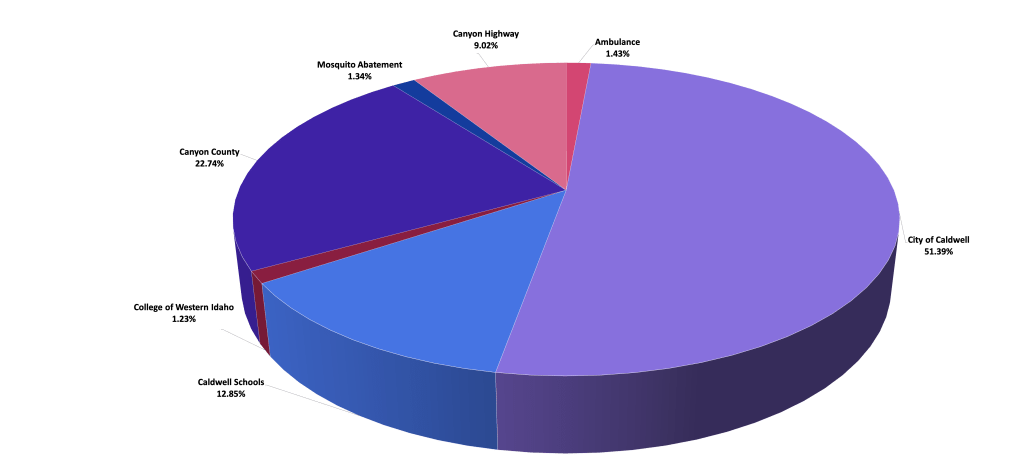

2023 Property Tax Distribution City of Caldwell

Average Taxable Value $233,775

Average Full Market Value $358,775

| Taxing District | Levy | Tax Amount | Percent |

| Ambulance | 0.000101437 | $ 23.71 | 1.43% |

| City of Caldwell | 0.003649751 | $ 853.22 | 51.39% |

| Caldwell Schools | 0.000912647 | $ 213.35 | 12.85% |

| College of Western Idaho | 0.000087502 | $ 20.46 | 1.23% |

| Canyon County | 0.001614778 | $ 377.49 | 22.74% |

| Mosquito Abatement | 0.000095288 | $ 22.28 | 1.34% |

| Canyon Highway | 0.000640835 | $ 149.81 | 9.02% |

| Total Tax | 0.007102238 | $ 1,660.33 |

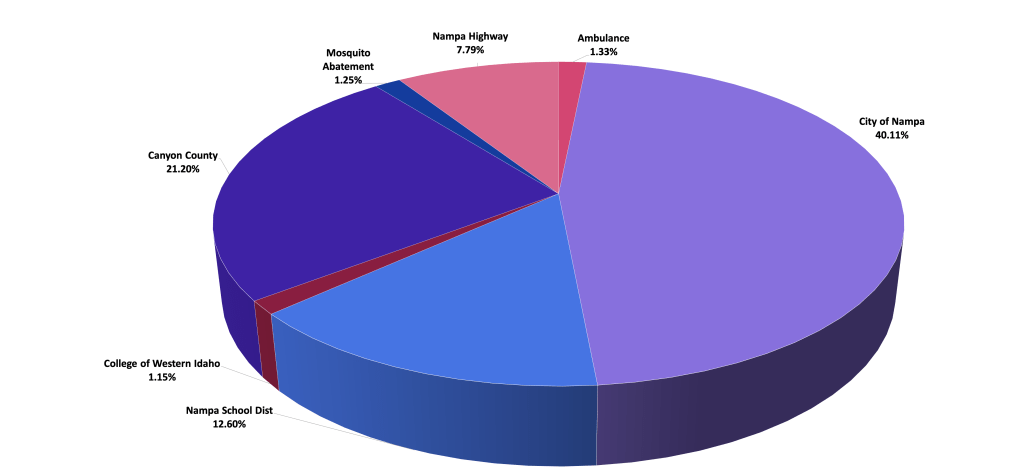

2023 Property Tax Distribution City of Nampa

Average Taxable Value $255,300

Average Full Market Value $380,300

| Taxing District | Levy | Tax Amount | Percent |

| Ambulance | 0.000101437 | $ 25.90 | 1.33% |

| City of Nampa | 0.003054964 | $ 779.93 | 40.11% |

| Nampa School Dist | 0.000959799 | $ 245.04 | 12.60% |

| College of Western Idaho | 0.000087502 | $ 22.34 | 1.15% |

| Canyon County | 0.001614778 | $ 412.25 | 21.20% |

| Mosquito Abatement | 0.000095288 | $ 24.33 | 1.25% |

| Nampa Highway | 0.000593054 | $ 151.41 | 7.79% |

| Nampa Fire | 0.001110571 | $ 283.53 | 14.58% |

| Total Tax | 0.007617393 | $ 1,944.72 |

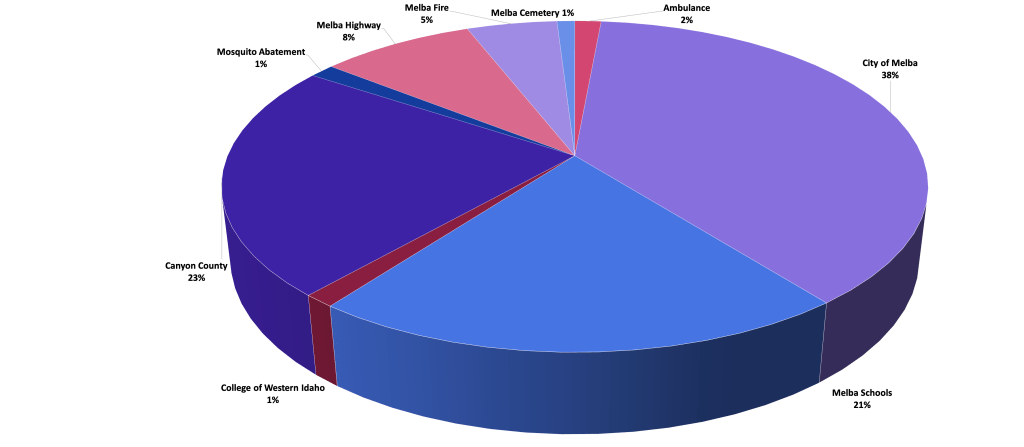

2023 Property Tax Distribution City of Melba

Average Taxable Value $166,000

Average Full Market Value $291,000

| Taxing District | Levy | Tax Amount | Percent |

| Ambulance | 0.000101437 | $ 16.84 | 1.44% |

| City of Melba | 0.002680307 | $ 444.93 | 37.95% |

| Melba Schools | 0.001473010 | $ 244.52 | 20.85% |

| College of Western Idaho | 0.000087502 | $ 14.53 | 1.24% |

| Canyon County | 0.001614778 | $ 268.05 | 22.86% |

| Mosquito Abatement | 0.000095288 | $ 15.82 | 1.35% |

| Melba Highway | 0.000593054 | $ 98.45 | 8.40% |

| Melba Fire | 0.000349252 | $ 57.98 | 4.94% |

| Melba Cemetery | 0.000068845 | $ 11.43 | 0.97% |

| Total Tax | 0.007063473 | $ 1,172.54 |

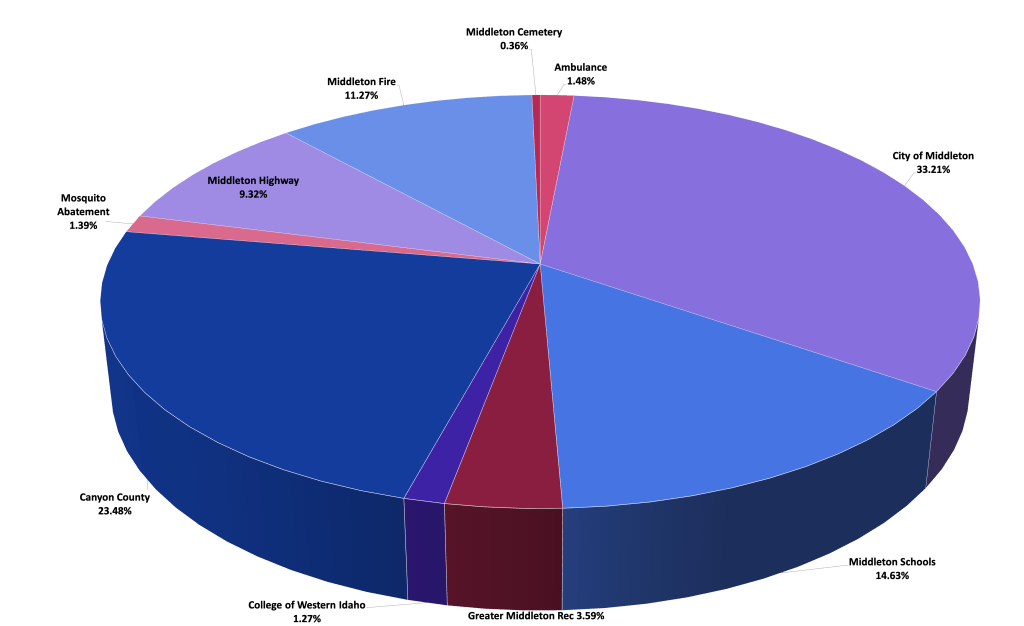

2023 Property Tax Distribution City of Middleton

Average Taxable Value $306,400

Average Full Market Value $431,400

| Taxing District | Levy | Tax Amount | Percent |

| Ambulance | 0.000101437 | $ 31.08 | 1.48% |

| City of Middleton | 0.002283780 | $ 699.75 | 33.21% |

| Middleton Schools | 0.001006087 | $ 308.27 | 14.63% |

| Greater Middleton Rec | 0.000246606 | $ 75.56 | 3.59% |

| College of Western Idaho | 0.000087502 | $ 26.81 | 1.27% |

| Canyon County | 0.001614778 | $ 494.77 | 23.48% |

| Mosquito Abatement | 0.000095288 | $ 29.20 | 1.39% |

| Middleton Highway | 0.000640835 | $ 196.35 | 9.32% |

| Middleton Fire | 0.000774927 | $ 237.44 | 11.27% |

| Middleton Cemetery | 0.000024810 | $ 7.60 | 0.36% |

| Total Tax | 0.006876050 | $ 2,106.82 |

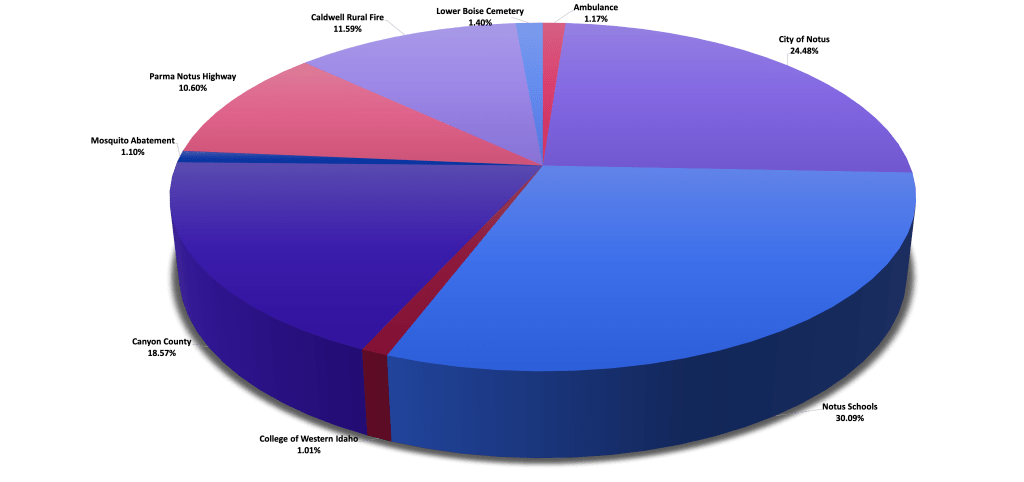

2023 Property Tax Distribution City of Notus

Average Taxable Value $169,000

Average Full Market Value $294,000

| Taxing District | Levy | Tax Amount | Percent |

| Ambulance | 0.000101437 | $ 17.14 | 1.17% |

| City of Notus | 0.002128753 | $ 359.76 | 24.48% |

| Notus Schools | 0.002616942 | $ 442.26 | 30.09% |

| College of Western Idaho | 0.000087502 | $ 14.79 | 1.01% |

| Canyon County | 0.001614778 | $ 272.90 | 18.57% |

| Mosquito Abatement | 0.000095288 | $ 16.10 | 1.10% |

| Parma Notus Highway | 0.000921777 | $ 155.78 | 10.60% |

| Caldwell Rural Fire | 0.001007825 | $ 170.32 | 11.59% |

| Lower Boise Cemetery | 0.000121653 | $ 20.56 | 1.40% |

| Total Tax | 0.008695955 | $ 1,469.62 |

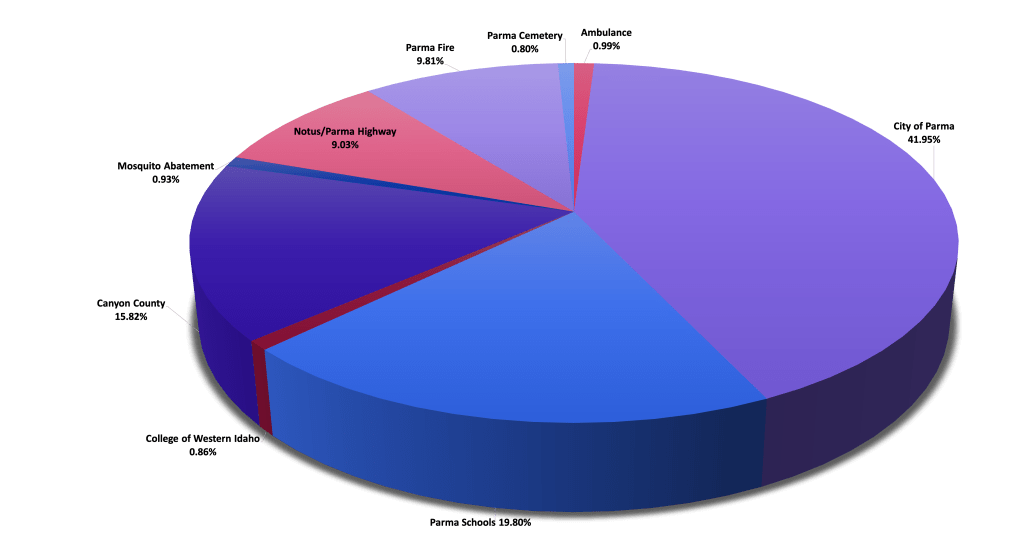

2023 Property Tax Distribution City of Parma

Average Taxable Value $160,625

Average Full Market Value $285,625

| Taxing District | Levy | Tax Amount | Percent |

| Ambulance | 0.000101437 | $ 16.29 | 0.99% |

| City of Parma | 0.004281855 | $ 687.77 | 41.95% |

| Parma Schools | 0.002021292 | $ 324.67 | 19.80% |

| College of Western Idaho | 0.000087502 | $ 14.06 | 0.86% |

| Canyon County | 0.001614778 | $ 259.37 | 15.82% |

| Mosquito Abatement | 0.000095288 | $ 15.31 | 0.93% |

| Notus/Parma Highway | 0.000921777 | $ 148.06 | 9.03% |

| Parma Fire | 0.001001394 | $ 160.85 | 9.81% |

| Parma Cemetery | 0.000081621 | $ 13.11 | 0.80% |

| Total Tax | 0.010206944 | $ 1,639.49 |

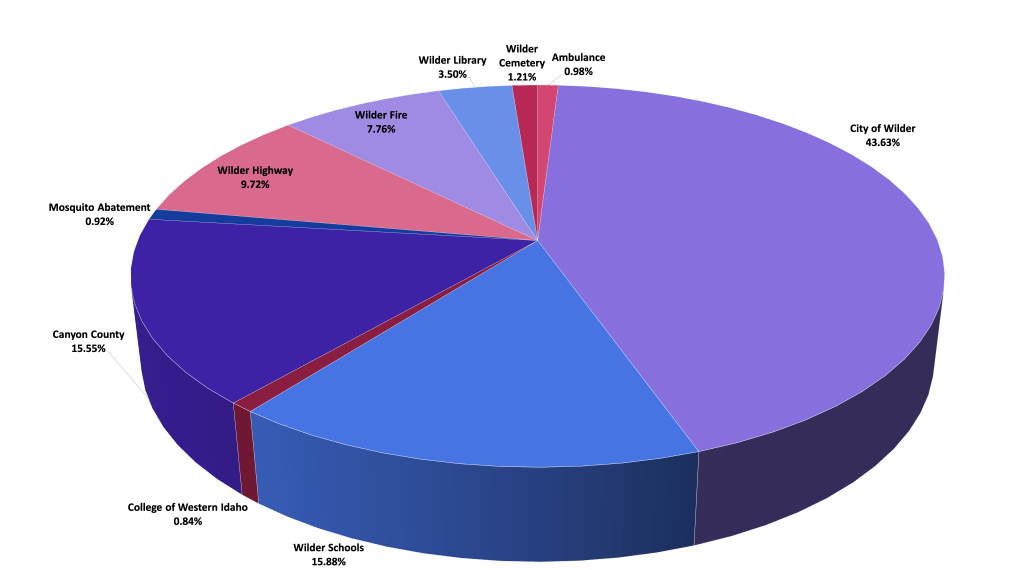

2023 Property Tax Distribution City of Wilder

Average Taxable Value in newer part of Wilder $203,550 (In older part of Wilder $119,625)

Average Full Market Value in newer part of Wilder $328,550 (In older part of Wilder $239,250)

| Taxing District | Levy | Tax Amount | Percent |

| Ambulance | 0.000101437 | $ 20.65 | 0.98% |

| City of Wilder | 0.004530763 | $ 922.24 | 43.63% |

| Wilder Schools | 0.001649567 | $ 335.77 | 15.88% |

| College of Western Idaho | 0.000087502 | $ 17.81 | 0.84% |

| Canyon County | 0.001614778 | $ 328.69 | 15.55% |

| Mosquito Abatement | 0.000095288 | $ 19.40 | 0.92% |

| Wilder Highway | 0.001009855 | $ 205.56 | 9.72% |

| Wilder Fire | 0.000805466 | $ 163.95 | 7.76% |

| Wilder Library | 0.000363941 | $ 74.08 | 3.50% |

| Wilder Cemetery | 0.000125881 | $ 25.62 | 1.21% |

| Total Tax | 0.010384478 | $ 2,113.76 |

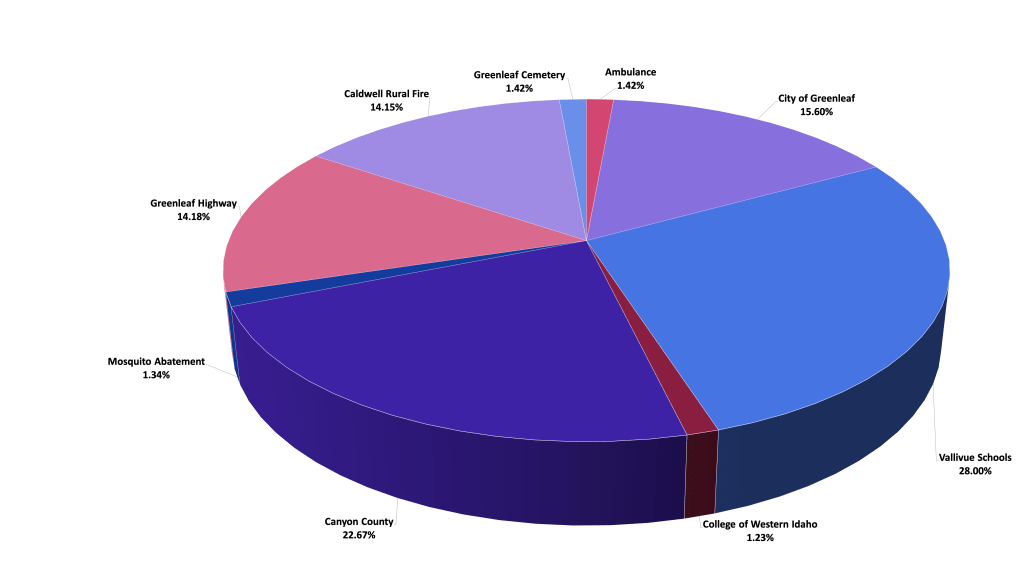

2023 Property Tax Distribution City of Greenleaf

Average Taxable Value $245,400

Average Full Market Value $370,400

| Taxing District | Levy | Tax Amount | Percent |

| Ambulance | 0.000101437 | $ 24.89 | 1.42% |

| City of Greenleaf | 0.001111195 | $ 272.69 | 15.60% |

| Vallivue Schools | 0.001994778 | $ 489.52 | 28.00% |

| College of Western Idaho | 0.000087502 | $ 21.47 | 1.23% |

| Canyon County | 0.001614778 | $ 396.27 | 22.67% |

| Mosquito Abatement | 0.000095288 | $ 23.38 | 1.34% |

| Greenleaf Highway | 0.001009855 | $ 247.82 | 14.18% |

| Caldwell Rural Fire | 0.001007825 | $ 247.32 | 14.15% |

| Greenleaf Cemetery | 0.000101285 | $ 24.86 | 1.42% |

| Total Tax | 0.007123943 | $ 1,748.22 |

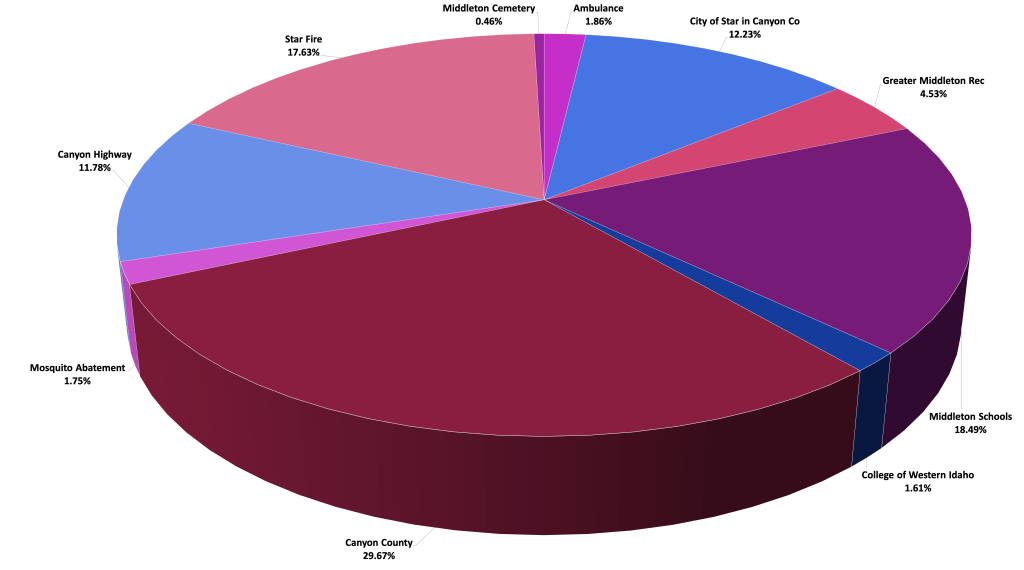

2023 Property Tax Distribution City of Star in Canyon County

Average Taxable Value $899,000

Average Full Market Value $1,024,000

| Taxing District | Levy | Tax Amount | Percent |

| Ambulance | 0.000101437 | $ 91.19 | 1.86% |

| City of Star in Canyon Co | 0.000665629 | $ 598.40 | 12.23% |

| Greater Middleton Rec | 0.000246606 | $ 221.70 | 4.53% |

| Middleton Schools | 0.001006087 | $ 904.47 | 18.49% |

| College of Western Idaho | 0.000087502 | $ 78.66 | 1.61% |

| Canyon County | 0.001614778 | $ 1,451.69 | 29.67% |

| Mosquito Abatement | 0.000095288 | $ 85.66 | 1.75% |

| Canyon Highway | 0.000640835 | $ 576.11 | 11.78% |

| Star Fire | 0.000959186 | $ 862.31 | 17.63% |

| Middleton Cemetery | 0.000024810 | $ 22.30 | 0.46% |

| Total Tax | 0.005442158 | $ 4,892.50 |

Main Assessor Location

111 N. 11th Ave Caldwell

Main Assessor - Suite 250

Plat Room - Suite 230

Rural Dept - Suite 220

Vehicle Registration Location

6107 Graye Lane, Caldwell

Vehicle Registration Online

MV@canyoncounty.id.gov

Auto License Contact

P 208-455-6020

F 208-454-6019

Main Phone / Fax

P 208-454-7431

F 208-454-7349

Office Hours

Weekdays 8am - 5pm

(excluding holidays)

DMV 8am - 4pm

(excluding holidays)