Taxing District Budgets

ASSESSORProperty tax is a major source of income for cities, counties, and special – purpose governments such as fire districts. The amount of property tax they receive each year is decided by their budget. See Determining Property Taxes. In Idaho, these taxing districts are allowed to increase the portion of their budget that is funded by property taxes by 3% plus a factor for growth see Idaho code 63-802.

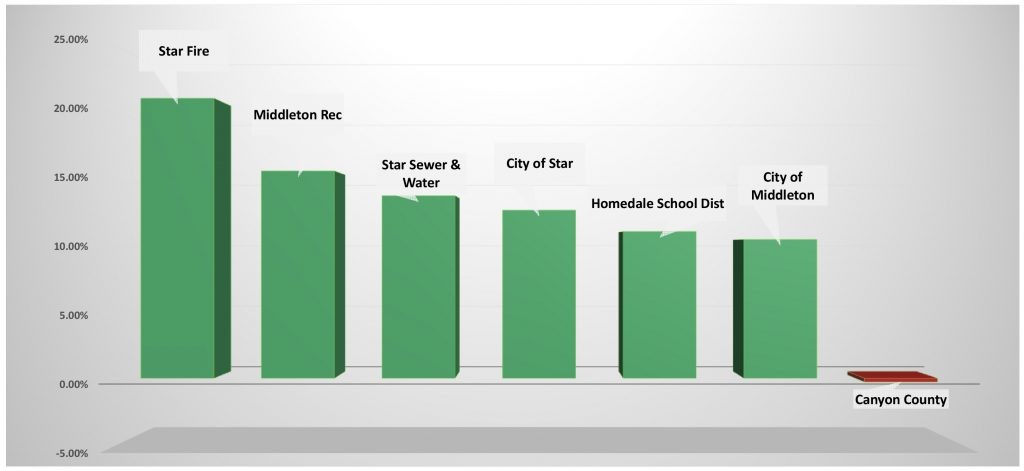

Below is a chart illustrating the budgets from a sample of the larger taxing districts in Canyon county and the difference in dollars they have requested from the tax payers.

Biggest Budget Changes FY 2021 – FY 2022

| Taxing District | FY 2021 | FY 2022 | Percent of Change 2021 – 2022 |

| Star Fire | $ 2,638,550 | $ 3,262,816 | 21.16% |

| Middleton Rec | 669,846 | 783,646 | 15.66% |

| Star Sewer & Water | 659,585 | 757,249 | 13.79% |

| City of Star | 1,306,208 | 1,483,413 | 12.70% |

| Homedale School | 1,275,789 | 1,425,628 | 11.09% |

| City of Middleton | 2,237,150 | 2,484,659 | 10.48% |

| Canyon County | $ 54,119,386 | $ 53,970,567 | -0.28% |

There is a misconception that the county controls the taxes. This is not true. The county does not hold control over the cities or any other taxing district. The county only has the authority to control our own budget. Property taxes are collected for most of the taxing districts through the county simply to streamline the process and reduce costs. You may be wondering – If the county isn’t keeping all of my money where exactly is it going? Use this link to see a chart of how money is disbursed among the taxing districts in your city.

Taxing District Budget FAQ

The way property tax calculation is structured in Idaho, the Assessor’s office is the only ‘face’ for the public to appeal to. No taxing district has a process outlined in Idaho code for the public to file an appeal on how their money is being spent. There is however, as there should be, a process to appeal the assessed value of your property. The problem is, many people file an appeal on their value when what they really want to do is appeal the amount of money they are required to pay. These type of appeals are unsuccessful and a source of frustration for everyone involved. A better course of action is to start by understanding how the process works. This information is made available to assist you in a more appropriate, and likely more successful, method of reducing your property taxes.

Below are many of the questions the Assessor is asked frequently.

Why is the city of Nampa’s budget almost as big as the county’s budget and more than twice as large as any other city?

Being the largest city in the county, it is reasonable to expect the City of Nampa to have the largest budget among the cities. Each taxing district, including cities, should be able to answer how they spend your money and the necessity to procure the amounts they ask for. For questions regarding a particular taxing district’s budget it is necessary to contact them directly. Phone numbers are printed on your assessment notice that is mailed in June.

Why isn’t Urban Renewal listed in the tables and charts?

Urban Renewal is not a taxing authority, although they do receive property tax dollars. Click here for a full explanation of Urban Renewal.

What can I do to stop an other budget increase?

Budget hearings are open to the public. To have an impact on the budget, you must attend the budget hearing. Each year the Assessor mails an assessment notice to each property owner in the county. This assessment notice informs you of a lot more than just your current assessed value versus last year. At the bottom of this notice is a list of all of the taxing districts supported by your property tax dollars. This list is specific to your exact property. Next to the the taxing district is the date of their next budget hearing and a phone number to contact them. Use the phone number to find out the time and location of the meeting and attend.

Each city’s pie chart is based on a different net taxable value. Why?

The net taxable value used for each pie chart is based on the median net taxable value for that area. This gives you an idea of what a typical homeowner in that city pays in property tax. These charts do not address the cost of services or other fees charged by the cities.

What is the Greater Middleton Area Recreational District?

The Greater Middleton Area Recreational District is an other taxing district in the Middleton area. Just like all taxing districts, their phone number is listed on your assessment notice. They are receiving your money. Call them and find out how you are benefiting from it.

I don’t live in city limits. How do I know where my taxes are going?

Look at the bottom of your assessment notice. This is where you’ll find a personalized list of taxing districts that are funded by your property taxes.

I got a letter about creating an improvement district. My area doesn’t need to be improved. How do I stop this district from being created?

The county does not have the authority to stop a taxing district from being created. The best thing to do when you receive a letter like this, is look for a contact number on the letterhead and call that number.

I get a bill for irrigation tax. I don’t have irrigation at my home. Why do I have to pay irrigation tax?

Irrigation districts are an example of a taxing district that does not use the county to calculate, bill, or collect taxes. Your questions on irrigation taxes can be answered at Idaho Department of Water Resources ![]() .

.

My tax bill has a taxing district that wasn’t listed on my assessment notice and it doesn’t have a tax rate. It is called “Wilder Speci”. What is this?

This is called a “City Special”. If you have incurred fines or fees that have gone unpaid for one reason or an other they can be tacked onto your property tax bill. There is not a tax rate because this charge is not a tax, but a fee. For questions regarding this fee contact the city named. The county does not have any information regarding how, why, or when this fee was incurred. See Idaho Code 63-1311

Main Assessor Location

111 N. 11th Ave Caldwell

Main Assessor - Suite 250

Plat Room - Suite 230

Rural Dept - Suite 220

Vehicle Registration Location

6107 Graye Lane, Caldwell

Vehicle Registration Online

MV@canyoncounty.id.gov

Auto License Contact

P 208-455-6020

F 208-454-6019

Main Phone / Fax

P 208-454-7431

F 208-454-7349

Office Hours

Weekdays 8am - 5pm

(excluding holidays)

DMV 8am - 4pm

(excluding holidays)