Urban Renewal

ASSESSOROne of the types of income urban renewal receives is property tax dollars. This may be why so many people come to the Assessor looking for answers on urban renewal. This page offers a brief overview of this complicated topic, but to truly understand urban renewal it is necessary to have a thorough understanding of how property taxes are calculated. Before proceeding on this page please read Determining Property Taxes to understand how property taxes are calculated in Idaho.

Purpose of Urban Renewal

Urban renewal is a program designed to more easily remedy areas of the community described as a ‘serious and growing menace, injurious to the public health, safety, morals and welfare of the residents…’ Idaho Code 50-2002. The local governing body (in most cases this is the city council) is tasked with determining when an area of the community meets this fairly subjective definition. In the past farm ground had been determined to meet this definition and thus picked up by urban renewal but amendments to the law in 2011 made this practice not nearly as advantageous as it had once been.

How An Urban Renewal District is Created

Prior to July 1, 2011 the creation of an urban renewal agency was decided upon by only the local governing body. Urban renewal agencies created after July 1, 2011 may not contract business or exercise its powers until it has been approved in an election by the public. Once the urban renewal agency is authorized, the mayor acting on the advice and consent of the local governing body, appoints a board of commissioners. The local governing body may designate themselves as the board of commissioners at any time. A complete description of the creation and authorization of an urban renewal agency can be found at: Idaho Code 50-2006.

How Urban Renewal Generates Income

Revenue for urban renewal is determined differently than it is for taxing districts such as school districts. The amount of income received by taxing districts is based on their budget, which is capped. (see Determining Property Taxes) Urban renewal is not a taxing district so the amount of income it can generate is unlimited. Urban renewal agencies generate income through the Local Economic Development Act Idaho Code 50-2902.

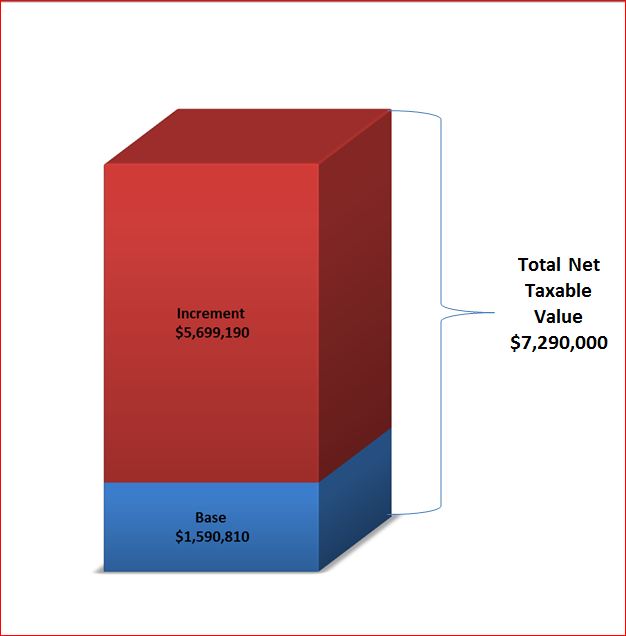

Urban renewal’s revenue is calculated by multiplying the levy rates of the taxing districts in its boundaries by the increment value. The Increment value is the amount that the assessed value of a property in an urban renewal district increases after the urban renewal district is put in place.

The assessed value of the properties in an urban renewal district at the time the district is put in place is called the Base value. The taxing districts that serve properties in the urban renewal district can only levy property taxes on the base value during the life of the urban renewal district. See section 4 of Idaho Code 50-2903.

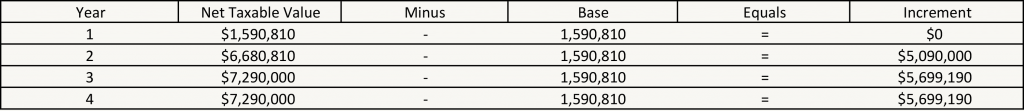

The table below calculates the increment value on an actual property that is located in an urban renewal district. The actual tax bills for this property can be found at the bottom of this page.

Calculating Base and Increment

The first year’s value is the base value. This means there isn’t an increment value the first year and urban renewal does not have income that year. Every proceeding year for the life of the urban renewal district (typically 24 years) the first year’s value is subtracted from the current year’s value to calculate the increment. The larger the increment the more income generated for urban renewal.

The first year’s value is the base value. This means there isn’t an increment value the first year and urban renewal does not have income that year. Every proceeding year for the life of the urban renewal district (typically 24 years) the first year’s value is subtracted from the current year’s value to calculate the increment. The larger the increment the more income generated for urban renewal.

How Urban Renewal Affects Taxing Districts

Since urban renewal limits the value that taxing districts can levy taxes on, levy caps are reached much sooner. Another way urban renewal restricts revenues for taxing districts is by capturing new construction income. Since taxing districts can only levy taxes on the base value, they are not able to collect on new construction located in urban renewal districts. See Idaho Code 50-2908. Taxes on new construction pay for growth such as added equipment and manpower needed for a fire department to adequately protect new buildings.

Taxing districts are required to support all of the structures and population within their districts regardless of the funds available to accomplish this, see Required County Services. Urban renewal districts often bring new construction and growth to the community. Taxing districts don’t see the revenue created by this growth until the urban renewal district ends which is typically around 24 years.

How Urban Renewal Affects All Tax Payers

Urban renewal causes levy rates to increase at a faster rate or in some cases not decrease as much as it would have otherwise. This means each tax payer is responsible for providing a larger percentage of the taxing district’s budget. This affects all properties whether or not they are in an urban renewal district.

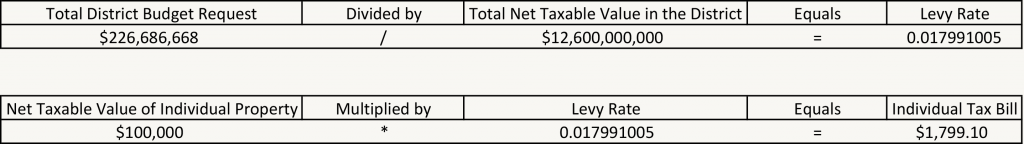

When there isn’t an urban renewal district in place, a taxing district levies taxes on the entire taxable value of every property in their code area. See the table below.

Taxes Calculated without an Urban Renewal District

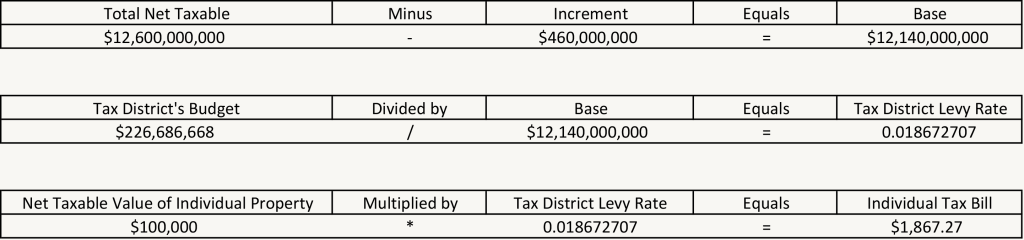

When an urban renewal district is in place, the taxing district must subtract the increment value (of the properties that are also in the urban renewal district) from the total assessed value of all of the properties within that taxing district. See the table below.

When an urban renewal district is in place, the taxing district must subtract the increment value (of the properties that are also in the urban renewal district) from the total assessed value of all of the properties within that taxing district. See the table below.

Taxes Calculated with an Urban Renewal District

The assessed value of the individual property and the taxing district’s budget are exactly the same in both instances above. Yet, the individual tax bill increased. This increase would be exactly the same if the property were inside or outside of the urban renewal district.

The assessed value of the individual property and the taxing district’s budget are exactly the same in both instances above. Yet, the individual tax bill increased. This increase would be exactly the same if the property were inside or outside of the urban renewal district.

It is possible for levy rates to decrease while an urban renewal district is active, but they will not decrease as much as they would have otherwise. Urban renewal will never cause the levy rate to decrease during its lifetime. The lifetime of an urban renewal district is typically 24 to 30 years.

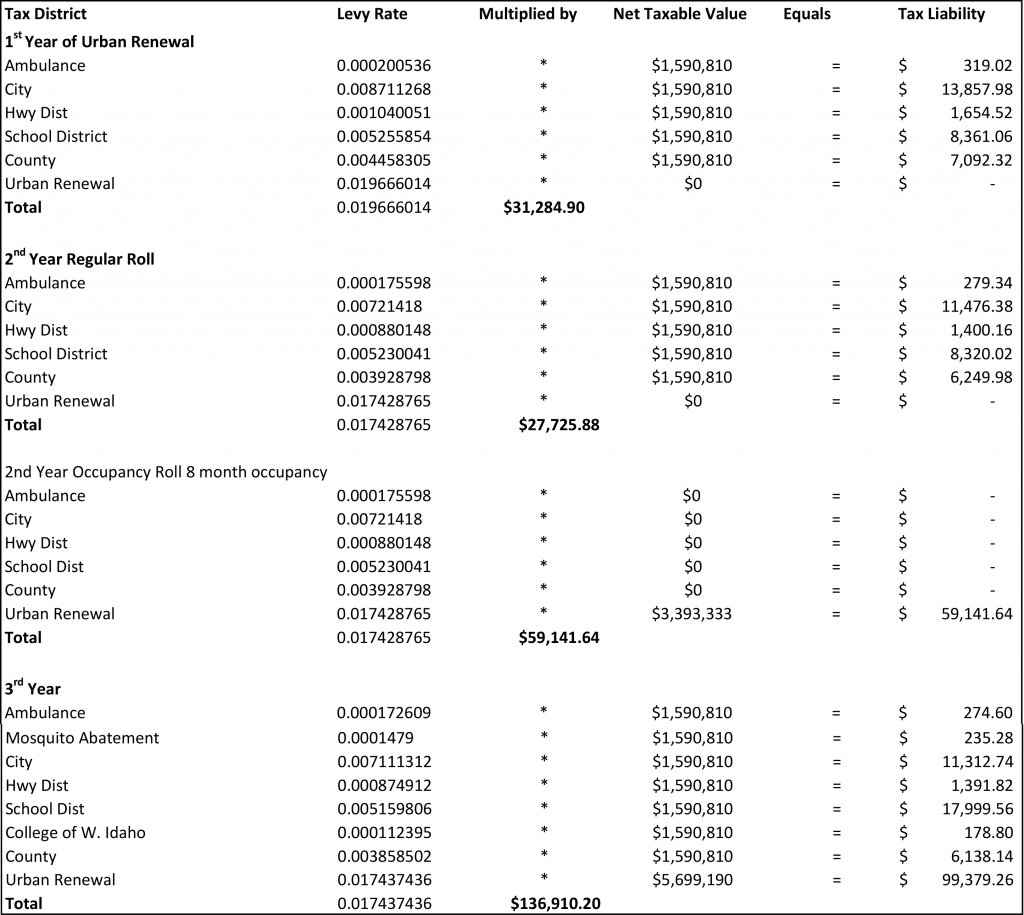

The table below display the breakdown of a tax bill from the first three years of this property going into an urban renewal district. Note there is not an increment value the first year which means no revenue for urban renewal.

The tables above display a breakdown of actual tax bills of one property in an urban renewal district. Note that urban renewal does not have its own levy rate. It adopts the levy rate of the code area it is in.

The tables above display a breakdown of actual tax bills of one property in an urban renewal district. Note that urban renewal does not have its own levy rate. It adopts the levy rate of the code area it is in.

Current Urban Renewal Revenue Allocation Area Maps & Data

Under Update – please check back soon…

There are three urban renewal districts in Canyon county. The Caldwell urban renewal district began in 1999 and was originally scheduled to end in 2014. An amendment was filed and now it is not scheduled to end until 2022. The latest Nampa urban renewal began in 2007 and is scheduled to end in the year 2030. Middleton just created an urban renewal district in 2009 and it is planned to remain active until 2033.

Main Assessor Location

111 N. 11th Ave Caldwell

Main Assessor - Suite 250

Plat Room - Suite 230

Rural Dept - Suite 220

Vehicle Registration Location

6107 Graye Lane, Caldwell

Vehicle Registration Online

MV@canyoncounty.id.gov

Auto License Contact

P 208-455-6020

F 208-454-6019

Main Phone / Fax

P 208-454-7431

F 208-454-7349

Office Hours

Weekdays 8am - 5pm

(excluding holidays)

DMV 8am - 4pm

(excluding holidays)