Property Tax

TREASURERProperties with Existing Homes

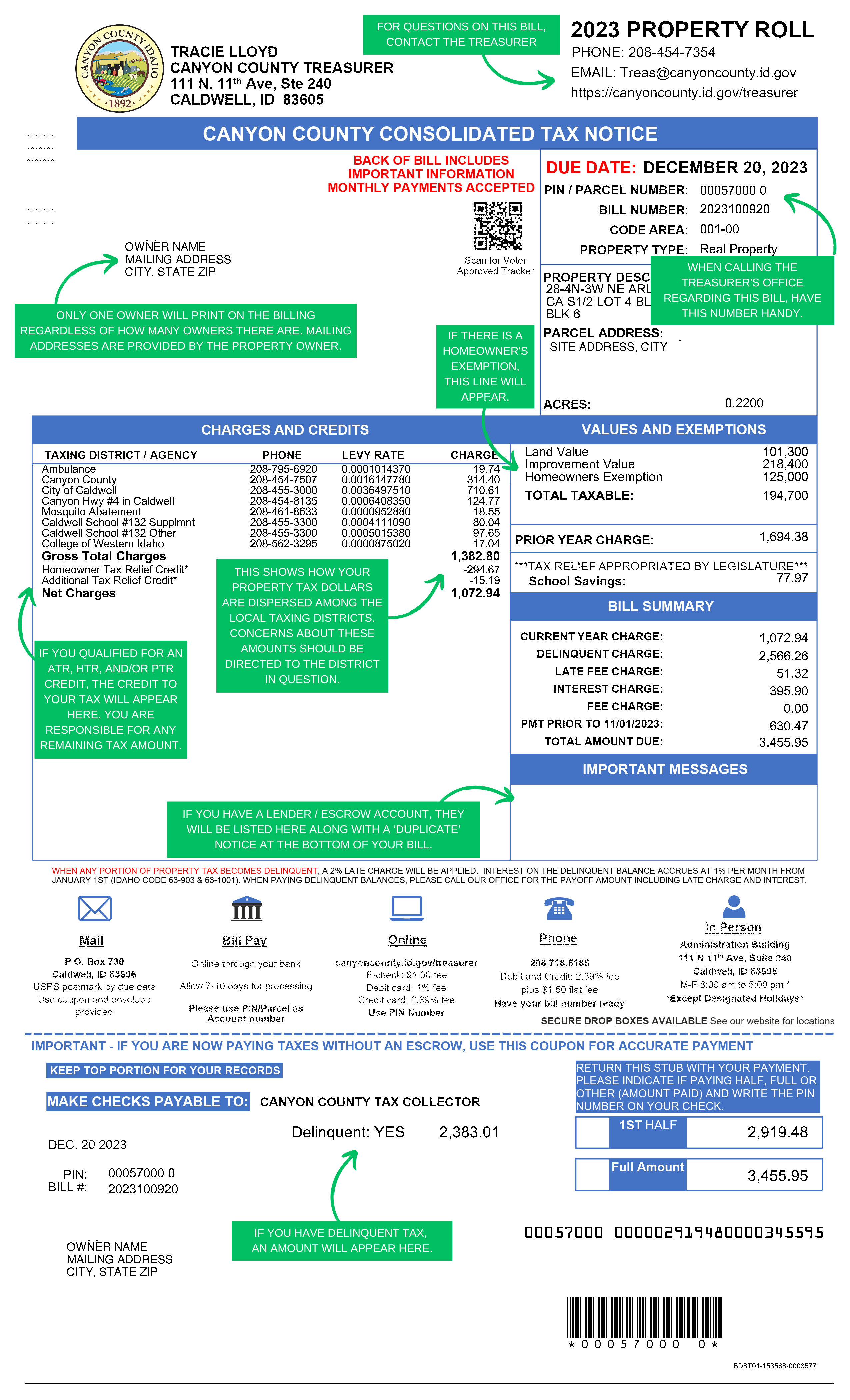

All tax notices are mailed annually by the 4th Monday of November.

Tax may be paid in two installments, by using a 6-month grace period

1. First half due December 20th

2. Second half due June 20th of the following year

If payment is not remitted by these due dates, associated penalty and/or interest fees will apply at 12% annually starting January 1st.

Properties with New Construction

You will receive a minimum of two (2) tax notices.

Your first tax notice for the land will be mailed in November is and due December 20th and June 20th.

The supplemental tax notice for the new construction will be mailed in February or March. The first installment will be due March 20th or April 20th. The second installment will be due June 20th. This tax notice is prorated from the time of occupancy or completion to December 31st of the previous year.

Mail Early

Payments mailed for the 1st half tax must be postmarked on or before December 20th and have a US Postal cancellation mark to be considered current. A postage meter is not an acceptable postal cancellation.

If the first half is not paid on or before December 20th, it becomes delinquent, and a 2% late charge shall be added. Interest on the delinquent tax and late charge is calculated at the rate of 1% per month beginning January 1st. If the first half tax is paid in part, late charge and interest is calculated on the remaining tax due.

Per Idaho code 63-902(9) the fact you do not receive a tax notice on any property does not excuse you from the tax or late charge and interest for non-payment.

If you have closed a business or purchased property during the year, or believe you have not received all your tax notices, please call (208) 454-7354 to inquire.

Each of the following programs are administered by the county Assessor’s Office. You may contact the Assessor’s Office by phone at (208) 454-7431 or via email at 2cAsr@canyoncounty.id.gov.

Homeowner’s Exemption

The Homeowner’s Exemption is exemption on part of the value of an owner-occupied primary residence, and up to one acre of land, including manufactured homes. More Details…

Property Tax Reduction (PTR)

Property Tax Reduction, formally known as Circuit Breaker, is a program that reduces property tax for qualified applicants. The amount of reduction is based on income for the previous calendar year. Applications are available from the Canyon County Assessor’s Office and must be received between January 1 and April 15th annually. More Details…

VA Credit Program

The Veterans Property Tax Benefit is a program that reduces property taxes for qualified veterans via a credit provided by the State Tax Commission. 100% service-connected disabled veterans in Idaho are eligible to have their property tax bill reduced by as much as $1,500 on their primary residence and up to one acre of land. Applications are available from the Canyon County Assessor’s Office and must be received between January 1 and April 15th annually. More Details…

Real Property

Real property consists of land and the improvements attached to it.

Personal Property

Personal property is equipment, furniture and/or fixtures used in a business. Idaho State Commission Tax ![]()

Manufactured Housing

Manufactured homes are generally considered personal property for the purpose of collection, seizure and sale. Only manufactured homes on a foundation, where all proper paperwork has been completed, are considered real property for the purpose of collection and tax deed.

Occupancy Tax

Occupancy tax is a prorated tax on newly constructed homes that have not been occupied for a full year. The value and tax is prorated from the time it was occupied until the end of the year.

Property tax is determined from the budget needs of each taxing district. Several kinds of taxing districts exist in Idaho. Levy taxes provide a wide range of services within the city and/or county. Other levy taxes are for specific purposes like highways, schools, and fire protection. Officials for each taxing district determine the annual budget needed to provide the district’s services. The approved budget to be funded by the property tax is divided by the total taxable value of all properties within the district. This determines the tax levy rate. This tax levy rate is multiplied by the taxable value of the property to determine the amount of tax you owe.

Tax levy rates can be affected by a variety of factors which include the taxing district’s emergency needs or voter approved bonds and override levies.

Levy rates are certified by the state by the end of October of each year.

Address

Caldwell, ID 83605

Mailing Address

Caldwell, ID 83606

P.O. Box 730

Caldwell, ID 83606

Phone / Fax

F 208-454-7388

Hours

(excluding holidays)